Providing you with knowledge, choices and a path to security and freedom in retirement

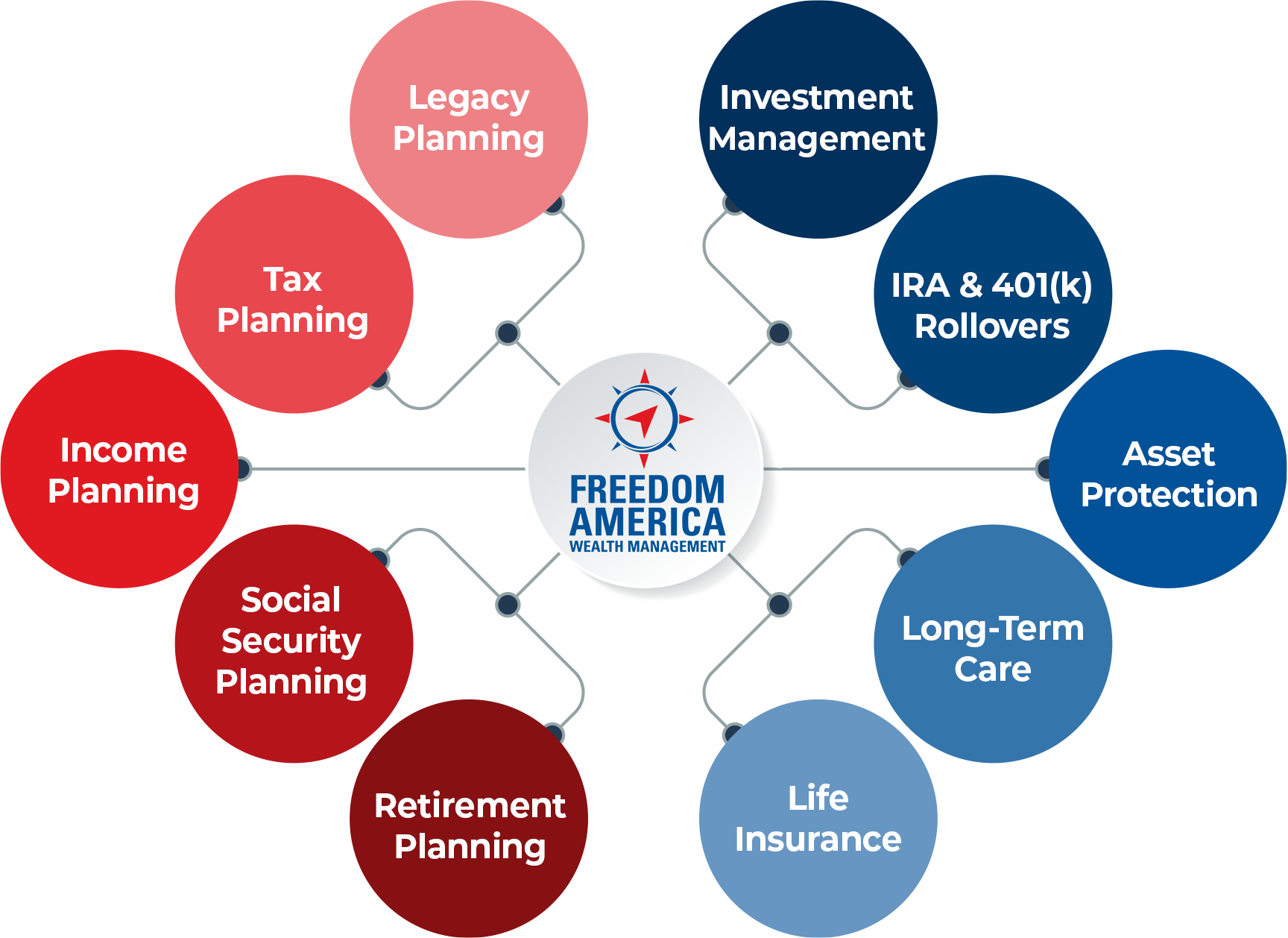

Navigating the way to freedom in retirement requires a 360 degree view of your whole financial picture. You have to address your income, your investments, your longevity, your current and future taxes, your living expenses, and anticipated inflation and interest rates to ensure you won’t run out of money. At Freedom America Wealth Management, we understand the complexities, and how each aspect of your finances affects the other.

A comprehensive approach to retirement planning is absolutely essential. We start with all of your sources of future retirement income, including pension options, 401(k)s, rental income, home equity and Social Security. Optimizing how you file for Social Security is essential—especially for couples. If you file early at 62, you’ll only receive 75% of your possible benefit. By waiting past your full retirement age (somewhere around age 66), you’ll be guaranteed an additional 8% per year up to age 70.

Once we have calculated your anticipated income, we build in factors for inflation and cost of living increases, and importantly, taxation. Because taxation can drastically affect your retirement income, especially when you must start withdrawing money from your tax-deferred accounts at age 73, we will take a look at the structure of each of your investments—which ones are tax-free, which are subject to capital gains taxes, and which will be taxed as income. Changes made now can impact future results.

Finally, we will take a look at what many financial advisors may overlook—your budget and living expenses. Because you will no longer be working, but instead must draw money out of your accounts, it is critical to anticipate expensive retirement risks like heath care, the potential need for long-term care, and what will happen to the surviving spouse when the other one passes. Going the extra mile, we’ll also help with legacy planning for your heirs.

More About Our Services

Freedom America Wealth Management is committed to helping you navigate the complexities of retirement so that you can retire securely and successfully. We work as a team with attorneys and tax professionals to create comprehensive retirement plans for couples, families and individuals in New England. Call us at (800) 679-0665.

Learn more about the importance of retirement income

Click on the video to listen to a discussion on the importance of retirement income.

Complimentary

Consultation

Schedule a no-fee, no-obligation appointment to learn more about how and when you might be able to retire securely!

Get to know us! Our offices are located in North Attleboro, Massachusetts and Warwick, Rhode Island. If you would like a more in-depth, personalized consultation, bring your financial documents along.